Financial Hardship, Depression, and Self-Esteem: Temporal Analysis Using a Korean Panel Study

Article information

Abstract

Objective

Financial hardship influences depression risk, however, the pathway of the effect of financial hardship on depression and the role of self-esteem remain unclear. This study examined whether changes in financial hardship affected depression, and whether self-esteem mediated by this relationship.

Methods

Data from 99,588 observations of 15,331 individuals were extracted from 10 waves of the Korean Welfare Panel Study. The association between changes in financial hardship and depression was investigated using a generalized estimation equation, and the extent to which these associations were mediated by self-esteem was assessed.

Results

The results indicated that changes in financial hardship were associated with depression, with varying magnitude. Experiencing severe financial hardship over two consecutive years (odds ratio [OR]: 3.87, 95% confidence interval [CI]=3.09–4.85) or increased financial hardship over the previous year strongly influenced depression (e.g., OR: 3.88, 95% CI=3.09–4.86 for low financial hardship at t-1 year and high at t year). Self-esteem plays a mediating role in the relationship between changes in financial hardship and depression, where persistent financial hardship is associated with low self-esteem, leading to depression.

Conclusion

These findings highlighted the importance of monitoring and intervention for financial hardship and psychological problems to help manage depression.

INTRODUCTION

Depression is a common chronic disease that affects overall health [1] and quality of life [2]. According to the Global Burden of Study, it is estimated that over 75 million years are lost to disability due to depression, accounting for 10.3% of the global burden of disease [3], with the social cost of depression gradually increasing. It is well-known that depression is influenced by socioeconomic shock [4], because low socioeconomic status (SES) is associated with psychological distress, leading to poor mental health. Thus, the impact of economic status on depression should be investigated.

Low SES is generally associated with poor mental health [5], demonstrating a stronger influence than on other health outcomes [5]. In addition to conventional SES measures, such as education level, household income, and employment status, financial hardship has been demonstrated to have a direct or mediating effect on to cancer, obesity, cognitive function, and mental health [6-10] because financial hardship is more responsive to everyday financial trouble [7] and is a severe stressor encountered during the life course [11-13]. Financial hardship occurs when people have difficulty satisfying the basic requirements of daily living, such as having difficulty of eating nutritious food, paying bills, or having inadequate medical care, due to insufficient financial resources [8].

A number of studies have included multiple dimensions of financial hardship and reported an association between multiple financial hardships and depression [6,12]. However, they were limited to changes in financial hardship due to the fact that respondents reported both previous and present financial hardship with different questions [6] or cross-sectional study [12]. Financial hardship may fluctuate more than conventional SES during the life course [6], and the magnitude of the association between changes in income and changes in depression found to be lower than financial hardship measures [14]. These provide an opportunity to investigate whether a temporal change in financial hardship is associated with depression. The influence of changes in multiple financial hardship on depression should be examined, as this may better reflect socioeconomic circumstances which makes it important to evaluate the dynamic effects of changes in financial hardship on depression overtime. Some advances have been made to explore the effect of changes in financial hardship on depression. Changes in financial hardship have been categorized as emerging, persistent, absent, and resolving [6,14-16] with studies consistently demonstrating that persistent and emerging financial hardship were associated with depression. However, this approach was a simple dichotomy of changes in financial hardship, limiting the variety of changes. Likewise, large changes in financial hardship may have greater impact on mental health rather small changes. Another approach is to treat multiple financial hardships as continuous. Although this approach overcomes the limitations of the degree of changes, it focuses on changes in financial hardship and ignores its level [14,17]. In other words, changes in financial hardship are too heterogeneous to be treated as the same group in their relation to depression, with varying extent of depression risk for persistent and emerging financial hardship.

Psychological factors have emerged as mediators that link financial hardship and poor mental health [18], with self-esteem being one of the most important. Self-esteem refers to a person’s evaluation of their value and worth [19] and may respond sensitively to the level of threats of adverse financial situations [20], suggesting a potential mediating role for the association between financial hardship and depression. However, clear evidence that self-esteem mediates the relationship between financial hardship and depression has not been uncovered [21,22], while one study demonstrated the lack of such a mediating effect [23]. Moreover, there is a scarcity of research showing that self-esteem accounts for the effect of changes in financial hardship on depression. Therefore, firm evidence regarding the mediating role of self-esteem in the relationship between financial hardship and depression has not been established. Investigating various changes in financial hardship would shed more light on the association between financial hardship and depression.

In South Korea (hereafter, Korea), suicide rate has been the highest among OECD countries over a decade and also the prevalence of depression was the highest in 2020 [24]. After Korea experienced two economic shocks including Asian financial crisis in 1997 and global economic crisis of 2008, suicide rate unprecedentedly increased, suggesting that understanding mental health issues in Korea needs to be addressed in a socioeconomic context. This study aimed to investigate whether the association between changes in financial hardship and depression was heterogeneous based on the level of changes and assess the extent to which self-esteem mediated this association using a representative sample of adults in Korea.

METHODS

Study sample

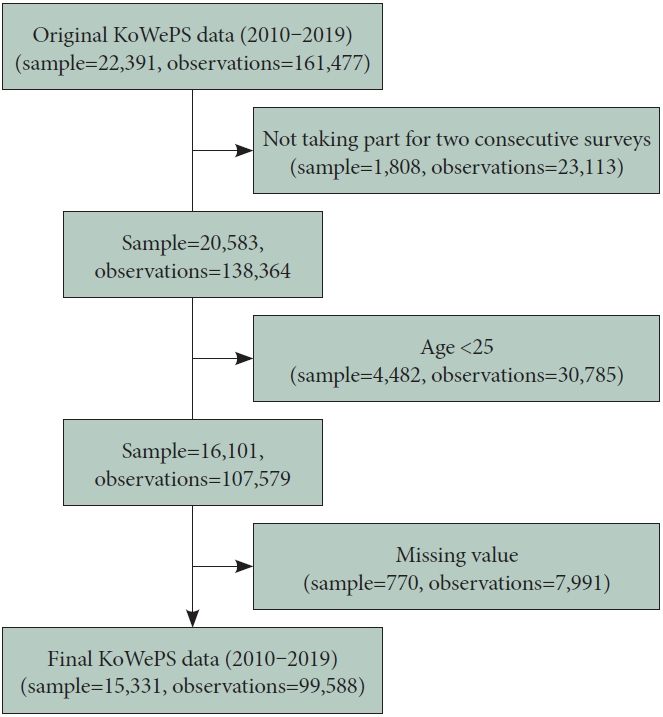

This study is longitudinal study using data from the Korean Welfare Panel Study (KoWePS), which is a nationally representative annual panel survey. The KoWePS used a multistage sampling method and selects households for face-to-face annual interviews covering detailed information about individual health and well-being, family resources and social welfare needs [25]. All participants are repeatedly surveyed during each wave. This study used data from 2010 to 2019. Since this study conceptualized a transition as happening over two years, between year t-1 and year t, only observations covering two consecutive years were retained for the analysis. Two-wave data were used to examine the effect of the changes in financial hardship on depression, as two-wave data are commonly used to control prior levels of outcome variables and assess the impact of events on health outcomes [26]. All individual aged 25 years or above at the baseline during the first wave (t-1) were followed up to the second wave (t). The final study population comprised 99,588 observations of 15,331 subjects (Figure 1).

Measures

Depression was the outcome variable, measured using 11 items from the Center for Epidemiological Studies-Depression (CES-D) [27], which inquired about how often the participants experienced specific depressive symptoms in the past week, rated on a four-point Likert scale. Depressive symptoms were measured dichotomously with a score of 16 or above considered as having depression [28]. The Cronbach’s alpha for the CES-D 11 scale in this sample ranged from 0.86 to 0.89.

The main explanatory variable was financial hardship, which was derived from a set of items based on previous studies [6,12,15,29]. Household heads responded whether they experienced the following seven items due to financial difficulties in the previous year: “having trouble paying rent or evicted for not paying rent,” “having trouble paying utility bills,” “having trouble heating the home in winter,” “having problems receiving medical services,” “family with bad credit,” “having problems paying national health insurance premium,” and “having problems eating nutritious food.” Each form of financial hardship was dichotomized as present or absent [29]. The seven financial hardship items at both t-1 and t waves were summed respectively, and a score from zero to seven indicated the number of financial hardships. A categorical measure was constructed, with zero as low-level financial hardship, one or two as medium financial hardship, and three or more as severe financial hardship. Changes in financial hardship were categorized into nine groups from low to severe financial hardship and from severe to low financial hardship. To measure the changes in financial hardship over two years (t-1 and t year), changes in financial hardship were categorized into nine groups: 1) low hardship to low, 2) low to medium, 3) low to severe, 4) medium to low, 5) medium to medium, 6) medium to severe, 7) severe to low, 8) severe to medium, 9) severe to severe.

Self-esteem was assessed using the Rosenberg Self-Esteem Scale (RSES), which is a ten-item self-reported questionnaire that measures positive self-regard [19], rated on a four-point Likert scale (0=strongly agree, to 3=strongly disagree). RSES scores were computed by summing the questions, ranging from zero to 30, with higher scores indicating higher self-esteem. A score of ≥26 was classified as high self-esteem, scores between 15 and 25 were considered moderate self-esteem, whereas scores of ≤15 indicated low self-esteem [30]. Self-esteem was collapsed into two categories for this study: high (≥16) and low (≤15). The Cronbach’s alpha for the RSES in this sample ranged from 0.73 to 0.77.

Other sociodemographic measures included gender, age group, marital status, educational attainment, employment status, and household income level at baseline. Age groups were categorized as 25–44, 45–64, and 65 or above. Marital status was categorized as married and single (including single, divorced, widowed, or separated). Educational attainment was classified into three groups according to graduation degree: middle school or lower, high school, and higher than college degree. Employment status was categorized as employed, and unemployed or economically inactive. Household income was categorized as 60% of the median equalized household income each year. Self-rated health was categorized into two groups (poor and moderate or good).

Statistical analysis

Descriptive statistics were used to present the general characteristics of all variables used in the study. Since the unit of analysis was the observation within individuals, a generalized estimating equation model was used to account for the interdependent observations within a participant [31]. To compare the association between the changes in financial hardships and depression, bivariate distribution and crude association were examined. To analyze multivariate associations, a series of adjustments for covariates and mediator were conducted in two steps. Model 1 was adjusted for SES (education level, household income, and employment status), marital status, subjective health, and survey year. For investigating the mediating effect of self-esteem, in Model 2, the explanatory power of self-esteem was calculated as a percent reduction of the odds ratio (OR) after the inclusion of self-esteem into the baseline model:

(OR in the baseline model [Model 1] - OR in the model adjusted for self-esteem [Model 2] / (1- OR in the baseline model [Model 1]) [32].

This approach has been widely used to estimate the mediated effect of pathway variables on the association between SES and health [33-35].

This study was exempted from ethical approval by the Institutional Research Board at Ajou University Hospital (AJIRB-SBR-EXP-21-555) because this study used secondary data without personal identifiers. The study was performed in accordance with the ethical standards outlined in the Declaration of Helsinki. All statistical analyses were conducted using SAS version 9.4.

RESULTS

Table 1 presents the general characteristics of the study sample. Of the 99,588 observations, 14.8% indicated depression. In addition, 4.7% of observations suggested that the participants experienced a transition from low to medium financial hardship, 0.4% from low to severe financial hardship, 0.4% indicated that the participants resolved severe financial hardship, and 0.4% indicated that the participants remained in severe financial hardship. The prevalence of depression was 14.8%, and 9.0% of observations indicated that the participants report low self-esteem.

General characteristics of the study sample pooled over ten waves (2010 to 2019) in Korean Welfare Panel Study

The bivariate associations between changes in financial hardship and depression are shown in Table 2. Individuals who experienced sudden or severe financial hardship and low self-esteem were more likely to report depression. The highest proportion of depression was among those who experienced persistent severe financial hardship, followed by medium to severe, and low to severe financial hardship. The prevalence of depression was 49.2% among those observations that had experienced persistent severe financial hardship during both waves, while 44.4% of observations that indicated a transition from low to severe financial hardship revealed depression. On the contrary, only 11.5% of observations indicating no financial hardships during both waves revealed depression. Likewise, the risk of depression was significantly greater for those who experienced persistent severe financial hardship (OR=4.18; 95% confidence interval [CI]: 3.40–5.14), medium to severe (OR= 3.93; 95% CI: 3.32–4.66), and low to severe (OR=3.72; 95% CI: 3.01–4.59). We observed that more than a half (58.9%) of observations that having low self-esteem reported depression and there was a significant association between self-esteem and depression (OR=6.28; 95% CI: 5.95–6.62).

Table 3 presents a multivariable logistic regression model examining the relationship between changes in financial hardship and depression after controlling for demographic, health-related and socioeconomic factors. For individuals in with low financial hardship in year t-1 and severe financial hardship in year t, persistent hardship increased the probability of depression, compared with the absent group (emerging hardship: OR=3.88, 95% CI: 3.09–4.86; persistent severe financial hardship: OR=3.87; 95% CI: 3.09–4.85). This indicated that the effect of emerging hardship on depression was similar to that of persistent severe financial hardship. In contrast, resolved hardship from severe to low financial hardship decreased the probability of depression after controlling for confounding factors. For individuals with severe to low hardship, the probability of depression decreased, compared with the absent group (OR=1.38; 95% CI: 1.08–1.76; medium to low hardship: OR=1.35; 95% CI: 1.25–1.45).

The multivariate association between changes in financial hardship and depression and percentage of total effect of financial hardship on depression due to self-esteem

When self-esteem was adjusted, the magnitudes of the associations between changes in financial hardship and depression were reduced. The attenuation in OR ranged from 18.4% to 40.1%, suggesting mediation of the differences among groups with different changes by self-esteem. The percent reduction mostly increased when financial hardship changes were negative. OR for medium-to-medium hardship decreased by 40.1%; OR for low to severe hardship decreased by 29.2%, OR for severe-to-severe hardship decreased by 30.3%, OR for severe to low hardship decreased by 18.4%.

DISCUSSION

Main findings

Using a national representative dataset, our study examined the association between changes in financial hardship and depression and found that individuals who transitioned from low to severe financial hardship or experienced persistent severe financial hardship were more likely to experience depression than individuals with decreased financial hardship or persistent low financial hardship. Furthermore, the results demonstrated a mediating role of self-esteem on the association between changes in financial hardship and depression.

Comparison with previous studies

Our findings provided further evidence of the association between dynamic changes in financial hardship and depression. Financial hardship shock (severe financial hardship in year t compared to year t-1) was strongly associated with depression, with a similar magnitude of association as persistent severe financial hardship (severe financial hardship in both t-1 and t), which is consistent with previous studies [6,15,29]. Similar to Butterworth et al. [6], our study demonstrated that prior financial hardship was associated with risk of depression; however, the magnitude of association was not pronounced, which emphasized that the present experience of financial hardship has a significant detrimental impact on mental health [16]. One possible explanation is that problems in meeting the necessities of living standards leads to feelings of despair, demoralization, and low self-esteem [6,8,29]. The burden that comes with a sudden or consistent threat of financial hardship may be sufficiently powerful to cause unbearable feelings. Likewise, when people encounter sudden or persistent multiple financial hardships, which could lead people to economic adversity, they are less likely to use their ability to improve their financial environment [6]. In particular, individuals recognize their financial situations as rapidly unstable and unsecure after unexpected multiple financial hardships, causing severe obsession with their financial situation. These individuals may tend to ruminate about their financial situation, resulting in more severe mental health problems [20].

On the other hand, individuals who resolved their financial hardship in year t from severe or medium financial hardship in year t-1 showed significant but lower likelihood of having depression. In particular, the magnitude of the association between financial hardship and depression was higher among those who experienced severe financial hardship in year t-1 and low financial hardship in year t than among those who experienced medium financial hardship in year t-1 and low financial hardship in year t. These associations between financial hardship and depression fluctuated depending on the degree of change during the short-term period. This suggested that timely intervention to decrease financial hardship is important, and continuous monitoring for those experiencing financial hardship is required.

This study identified the association between financial hardship and depression mediated by self-esteem. The difficulties in meeting the basic requirements for living standards due to a lack of financial resources could cause feelings of frustration, worry, and stress and may decrease self-esteem or positive mental health, which often precedes depression [6]. A possible explanation is that individuals who experienced financial hardship or failure could be doubtful of their worth and importance as human beings. They may regard themselves as worthless and unaccomplished, perceiving a diminished social position [18,36]. Individuals with low self-esteem are more likely to avert social participation and interactions, leading to a reduction in available social capital, such as reciprocity and social support. This contributes to an increased level of depression [37,38].

Moreover, depression may be dependent on the extent of financial hardship changes, with reductions in self-esteem to the extent to which vulnerability to depressive symptoms is increased [39,40]. Another explanation is that Korea has achieved rapid economic growth and people generally expect a prospering economic situation in their lives. However, when faced with great economic instability, such as the Asian financial crisis, people were susceptible to big shocks. After a relatively rapid economic recovery, economic growth paradoxically remained, along with intense competition, leading to an obsessive social comparison. Therefore, Korea has experienced rising suicide rates and increased income inequality [41]. Similarly, according to a Pew Research Center global survey of what makes life meaningful, most countries reported that family provides meaning in life, while Korea cited material well-being [42]. With material properties considered as markers of social standing, maintaining economic prosperity is regarded as achieving success and the social perception that individuals who experience emerging or persistent financial hardship are left behind may accelerate further low self-esteem. Therefore, alleviating financial hardship is important, and mental health and psychological interventions should be considered for suicide prevention.

Strengths and limitations

This study had several strengths. First, data pooling with repeated measures within individuals provided a chance for maintaining and experimenting with rare cases such as financial hardship over two years. Second, this study was characterized by changing the nature and degree of changes. This enabled investigation of the dynamic impact of changes in financial hardship on depression, which has been neglected in previous studies [6,8,15,29]. Third, this study examined whether self-esteem as a mediator in the association between financial hardship and depression. Although financial hardship was independently associated with suicidal ideation in a previous study, our study demonstrated the impact of financial hardship on psychological factors and depression. This study had several limitations. First, this study analyzed data over two waves, focusing on the short-term impact of financial hardship on mental health, which was in line with previous studies [6,8,15,29]. However, the effect of financial hardship on depression may be long-term, suggesting that further research on the long-term impact of financial hardship should be conducted. Second, this study did not consider the onset or duration of depression. The predictive power of t-1 financial hardship was largely explained by the inclusion of baseline depression symptoms. However, controlling for baseline mental illness may be over-adjusted for the effect of financial hardship [6]. Similarly, although this study analyzed data over two waves, limited or reverse causation could not be excluded due to a partial overlap in the study period between changes in financial hardship and depression.

Conclusion

Increasing or persistent financial hardship was associated with depression and self-esteem was mediated from this association. Supports for alleviating financial hardship and increasing self-esteem might be necessary. Furthermore, inclusive culture or behavior may be needed for those who experience economic failure or hardship in highly competitive or materialistic society.

Notes

Availability of Data and Material

The datasets generated or analyzed during the study are available from the corresponding author on reasonable request.

Conflicts of Interest

The authors have no potential conflicts of interest to disclose.

Author Contributions

Conceptualization: Minjae Choi, Yo Han Lee. Data curation: Minjae Choi. Formal analysis: Minjae Choi, Joshua Kirabo Sempungu. Funding acquisition: Minjae Choi, Yo Han Lee. Investigation: Minjae Choi, Joshua Kirabo Sempungu. Methodology: Minjae Choi, Yo Han Lee. Visualization: Eun Hae Lee, Joshua Kirabo Sempungu. Writing—original draft: Minjae Choi. Writing—review & editing: Eun Hae Lee, Joshua Kirabo Sempungu, Yo Han Lee.

Funding Statement

This study was supported by grants from the Korea University awarded to Yo Han Lee and by the Global PhD Fellowship Program through the National Research Foundation of Korea (grant number NRF-2018H1A2A1059973) awarded to Minjae Choi.